Grocery stores and dining at restaurants including takeout and eligible delivery services home improvement stores such as home depot and lowe s and select.

Chase sapphire reserve price protection on flights.

Is coverage different for the reserve vs the preferred.

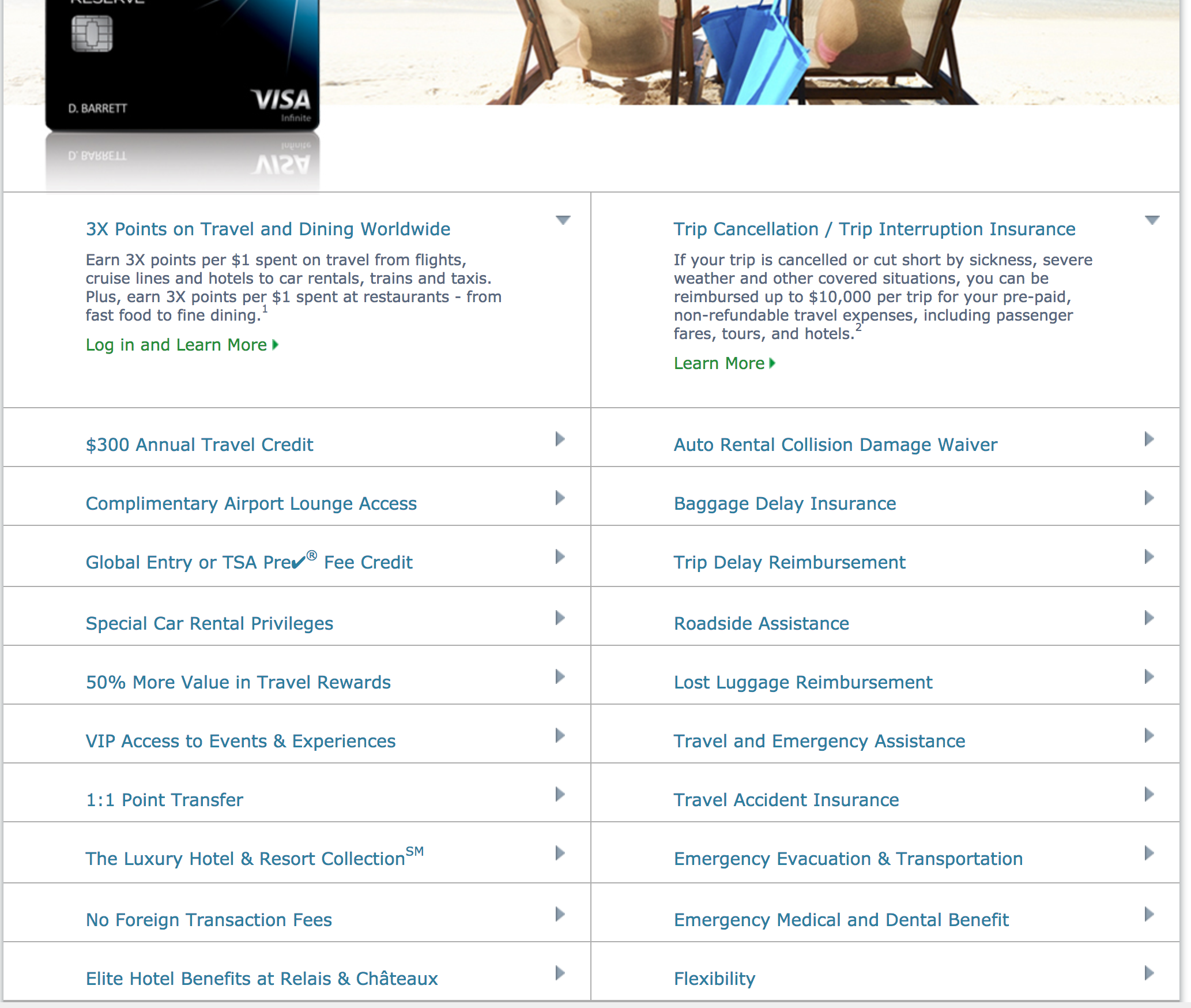

The chase sapphire reserve card offers a package of travel insurance benefits that can save you money offer travel protections and provide peace of mind.

Image by taimy alvarez sun sentinel via getty images image by taimy alvarez sun sentinel via getty images the baggage delay insurance covers the cardholder the cardholder s spouse or domestic partner and immediate family members for up to 100 per day for a maximum of five days.

So i used my card for dining out and booking travel.

The chase sapphire reserve covers you if your baggage is lost or delayed.

The chase sapphire preferred full review here only gets coverage up to a maximum of 500 per claim and up to 50 000 per account while the sapphire reserve gets up to 10 000 per claim.

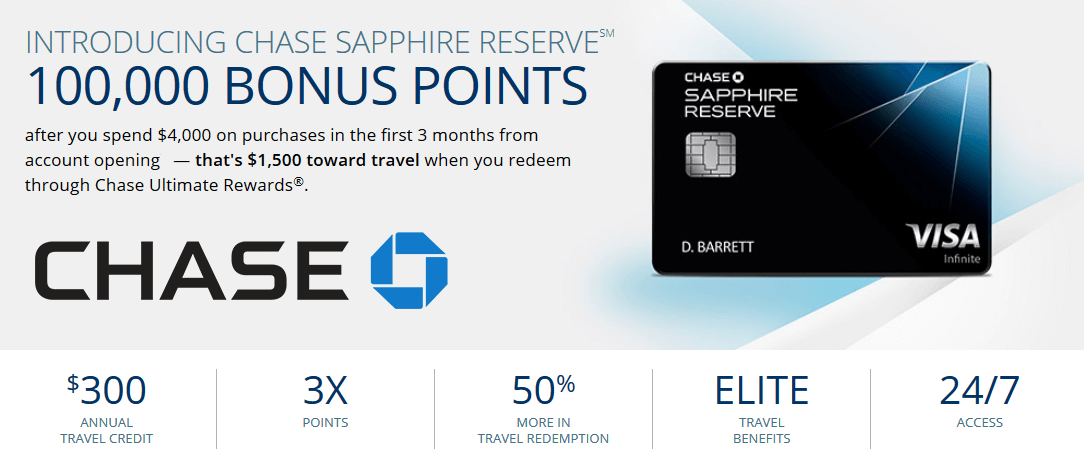

Few credit cards can compete with the chase sapphire reserve card when you re looking for a premium travel rewards credit card.

The following information is a summary only.

Please see your guide to benefits for complete details.

The chase sapphire reserve and the chase sapphire preferred have very different purchase protection limits.

So i used my card for dining out and booking travel.

So if you but a ticket and the price falls will price protection cover the difference.

See the top of.

Tickets are explicitly excluded from coverage.

Benefit overview provides reimbursement for the difference in.

Does the price protection offered by chase sapphire reserve cover airline tickets.

Price protection this benefit will be discontinued on 8 26 2018.

Return protection is only offered by 2 chase credit cards.

Sapphire reserve is broadening your world of benefits with the pay yourself back tool your ultimate rewards points are worth 50 more when you redeem them for statement credits against purchases in our current categories.

Recipients of gifts purchased by the cardholder with an eligible chase card coverage amount period up to a maximum of 10 000 per claim and up to 50 000 per year what s covered eligible personal property that has been.

Two of the strongest benefits include a 300 travel credit along with the ability to earn 3x on dining and travel.

If you are unhappy with an item you purchased entirely on a card that has return protection and the store won t take the merchandise back you may be eligible for a reimbursement for the cost of the item.

/chase-sapphire-preferred-d8cc6e87e5474245b576947076252332.jpg)